Getting The Guided Wealth Management To Work

Getting The Guided Wealth Management To Work

Blog Article

The Guided Wealth Management Ideas

Table of ContentsThe 5-Second Trick For Guided Wealth Management5 Easy Facts About Guided Wealth Management DescribedGuided Wealth Management Can Be Fun For AnyoneThe Facts About Guided Wealth Management RevealedFacts About Guided Wealth Management Revealed

The consultant will establish up a possession appropriation that fits both your danger resistance and danger capability. Property appropriation is simply a rubric to determine what percentage of your overall monetary portfolio will be dispersed across various property classes.

The ordinary base pay of an economic consultant, according to Certainly as of June 2024. Note this does not consist of an estimated $17,800 of annual compensation. Any individual can deal with a financial advisor at any kind of age and at any phase of life. financial advisor north brisbane. You do not have to have a high total assets; you just have to locate an advisor fit to your scenario.

Some Known Incorrect Statements About Guided Wealth Management

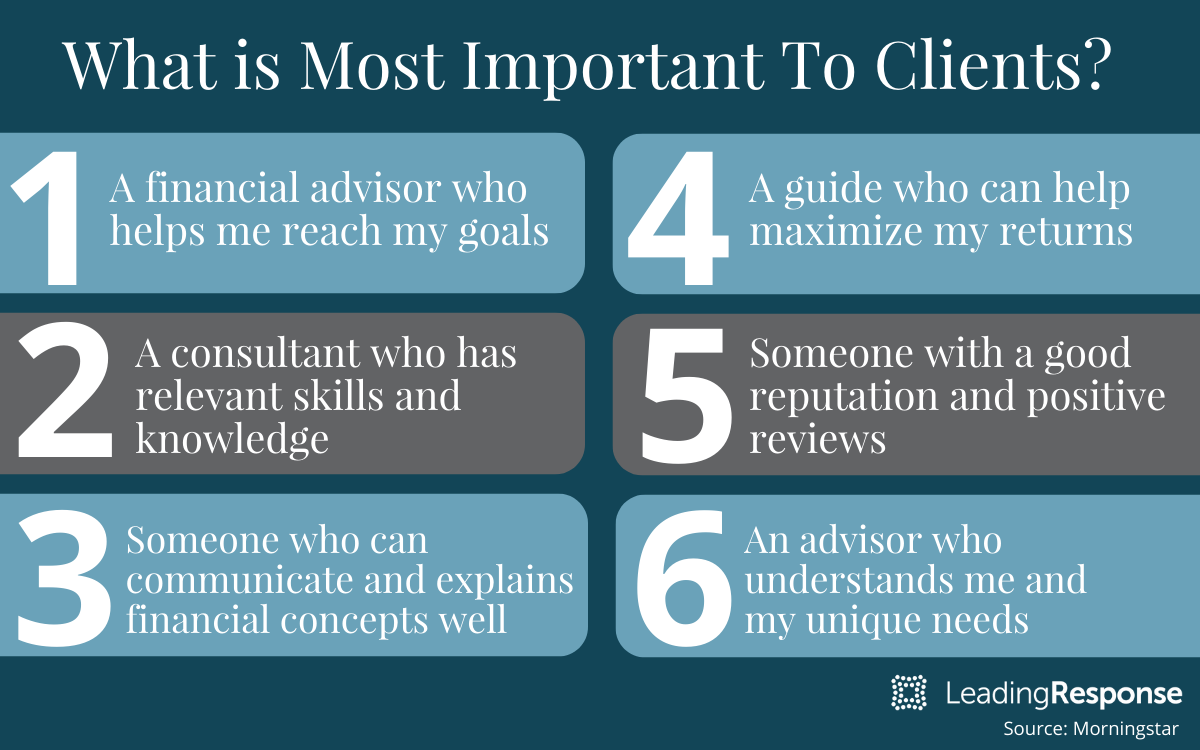

If you can not manage such aid, the Financial Planning Association may be able to aid with pro bono volunteer support. Financial advisors work for the customer, not the business that uses them. They should be receptive, happy to clarify financial principles, and keep the customer's benefit at heart. Otherwise, you must look for a brand-new advisor.

A consultant can suggest possible enhancements to your plan that could assist you achieve your objectives extra properly. If you don't have the time or interest to handle your financial resources, that's another good reason to work with an economic expert. Those are some basic reasons you might require an advisor's professional assistance.

A great monetary expert shouldn't simply sell their services, yet supply you with the devices and sources to come to be monetarily savvy and independent, so you can make enlightened decisions on your very own. You desire a consultant that stays on top of the economic scope and updates in any type of location and who can address your economic questions about a myriad of subjects.

The Greatest Guide To Guided Wealth Management

Others, such as licensed monetary coordinators(CFPs), currently stuck to this standard. Under the viability requirement, monetary experts usually function on compensation for the items they sell to customers.

Fees will additionally vary by area and the advisor's experience. Some experts might use lower prices to help customers who are simply beginning with monetary planning and can not pay for a high regular monthly rate. Commonly, an economic consultant will provide a totally free, initial examination. This consultation gives an opportunity for both the client and the consultant to see if they're a great fit for each other - https://www.avitop.com/cs/members/guidedwealthm.aspx.

A fee-based monetary advisor is not the very same as a fee-only financial advisor. A fee-based consultant may make a charge for creating a financial prepare for you, while likewise making a commission for offering you a specific insurance policy item or financial investment. A fee-only economic expert gains no payments. The Stocks and Exchange Commission (SEC) proposed its own fiduciary guideline called Policy Best Interest in April 2018.

The Ultimate Guide To Guided Wealth Management

:max_bytes(150000):strip_icc()/ria.asp-final-88c8a25158a4433189b6796713a7ae3c.png)

Robo-advisors do not require you to have much money to obtain started, and they set you back less than human economic advisors. A robo-advisor can't talk with you regarding the finest means to obtain out of debt or fund your child's education and learning.

A consultant can aid you figure out your cost savings, exactly how to construct for retired life, help with estate planning, and others. If however you only need to go over profile allotments, they can do that also (usually for a fee). Financial consultants can be paid in a variety of ways. Some will be commission-based and will certainly make a percent of the items they guide you into.

Indicators on Guided Wealth Management You Should Know

Marriage, separation, remarriage or just relocating in with a new partner are all milestones that can ask for cautious preparation. As an example, along with the typically difficult psychological ups and downs of divorce, both companions will need to handle vital financial considerations (https://issuu.com/guidedwealthm). Will you have sufficient income to sustain your way of life? How will your investments and various other properties be split? You may very well need to alter your financial strategy to maintain your goals on course, Lawrence claims.

An unexpected increase of cash money or possessions elevates immediate inquiries regarding what to do with it. "A financial consultant can help you assume via the ways you might place that cash to work toward your individual and financial goals," Lawrence states. You'll wish to consider just how much could go click now to paying for existing debt and just how much you may consider investing to seek a more safe future.

Report this page